Learn About Risk Retention Groups

Risk Retention Groups, also known as RRGs, are entities owned by their insureds and authorized to underwrite the liability insurance risks of their owners. RRG owners must be from a homogenous industry group and based on a single state license are able to operate in all 50 states and the District of Columbia.

Risk Retention Groups’ many benefits to their members include:

- Combined purchasing power

- Tailored homogenous insurance program

- Share in underwriting profits and related investment income

- Flexibility with respect to coverage forms and claims handling

- Incentive for risk management and loss control

- Access to reinsurance markets

Think an RRG is right for you? See our Risk Retention services

RRG Structural Options

RRGs can be licensed as a traditional insurer or as a captive insurer, with most RRGs opting to form under a state’s captive insurance code to permit greater flexibility with respect to the use of GAAP accounting for financial reporting and the ability to use Letters of Credit for capitalization.

RRGs may be formed under most corporate structures, including a stock, mutual, or LLC basis company. RRGs can also be formed as a reciprocal insurer, which can provide very beneficial tax treatment when the underlying insureds are all qualifying non-profit entities.

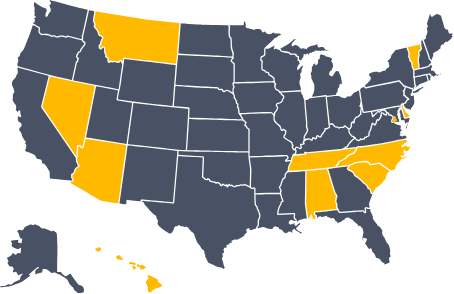

Domicile Options

RRGs can be formed in any state, as well as in the District of Columbia. Risk Services is approved to serve as a captive manager of RRGs in all of the following domiciles:

- Vermont

- South Carolina

- District of Columbia

- Nevada

- Hawaii

- Arizona

- Tennessee

- Montana

- North Carolina

- Alabama

- Delaware

RRG Lines of Business & Industry Areas

RRGs are able to write liability lines of coverage, which include but are not limited to:

- Medical Professional Liability

- Miscellaneous Professional Liability

- Commercial General Liability

- Commercial Auto Liability

- Environmental Liability

- Cargo Liability

- Contractual Liability (Used primarily for warranty products and other unique applications)

RRGs are often used to address industries that are subject to cyclical or distressed liability insurance issues. Additionally, RRGs are often used to address niche industry sectors and solve unique liability insurance needs. Industry areas commonly utilizing the RRG model include:

- Transportation

- Long-Term Care Facilities

- Physicians and Medical Practitioners

- Hospitals and Affiliates

- Property Development and Homebuilders Warranty

- Vehicle Extended Service Contracts

- Financial Services

- Professional Services

- Government and Institutions

- Non-Profits

- Hospitality

- Leisure

Financial Strength Ratings

RRGs can secure an AM Best rating in the same way as any traditional insurance carrier. Typically, newly-formed RRGs will not have the capitalization levels or operating history to initially secure an AM Best rating. Many RRGs secure a rating from alternative rating agencies, such as Demotech, which is an approved rating agency by HUD.

For unrated RRGs that have some members requiring liability insurance from an “A” rated carrier, Risk Services can help. We have a proven history of developing unique solutions to address such needs.

Risk Services is recognized as an industry leader in the Risk Retention Group industry, having formed more Risk Retention Groups over the past decade than any other captive manager in the United States. Whether it’s the formation and management of a new RRG, assuming management services for an existing RRG group, or facilitating a RRG redomestication, Risk Services has the expertise to aid your RRG program in reaching its goals.

Contact Risk Services

Let Risk Services help you navigate through the alternative insurance maze. Reach out to discuss how our innovative insurance solutions can fulfill your business needs.

Contact UsRogerisms

“Mind the gap.”

In London, this means beware of the gap between the concourse and the subway car. In captive insurance, this means beware of the collateral required by the fronting carrier between the loss fund and the aggregate attachment point.

[rä-jer-izem]Words of wisdom from our CEO, Michael Rogers

“The staff at Risk Services are amazing. From licensing, to registration nationwide, to subsequent annual filings, Risk Services is there to aid and guidance every step of the way. Their professionalism and knowledge of the insurance industry is unparalleled, and they accomplish this while being approachable and pleasant in all communications.”

Duane Barrick, Eagle Builders Insurance Company Risk Retention Group, Inc.